In the swiftly progressing digital finance realm, two cryptocurrencies consistently capture attention: Bitcoin and Ethereum. Both are built on blockchain technology and have earned recognition as influential digital assets, but their purposes and architectures are distinct. Bitcoin, the pioneer in this space, was created as a decentralized alternative to traditional currency for secure, peer-to-peer transactions. Ethereum, on the other hand, provides a versatile platform that supports decentralized applications (DApps) and self-executing smart contracts, enabling a broad range of possibilities beyond simple currency exchange.

The appeal of Bitcoin and Ethereum represents more than a passing trend; it signals a significant shift toward the acceptance of digital assets. Bitcoin has established itself as a “digital gold,” valued for its deflationary nature and appeal as a store of value. Meanwhile, Ethereum’s smart contract capabilities have expanded blockchain’s potential, fostering innovations in decentralized finance (DeFi), gaming, and other sectors.

Impact of Bitcoin and Ethereum on the Digital Market

Bitcoin and Ethereum have each contributed to the rapid adoption of blockchain technology in different ways. Bitcoin’s strong network and reputation as a secure, decentralized currency make it a popular entry point for new cryptocurrency investors. Ethereum, however, provides the foundation for a decentralized internet known as Web3, built on blockchain infrastructure and open-source principles.

Diverging Philosophies and Technologies

Bitcoin and Ethereum were designed with vastly different goals. Bitcoin emphasizes decentralization and security, with a fixed supply cap that protects its value over time. Ethereum, however, is oriented toward fostering innovation, allowing developers to build DApps and execute smart contracts.

Bitcoin utilizes a proof-of-work (PoW) consensus mechanism, which ensures security but has been criticized for its environmental impact. Ethereum has shifted to a proof-of-stake (PoS) model with Ethereum 2.0, improving scalability and energy efficiency. This evolution represents the separate paths Bitcoin and Ethereum have taken, each focused on realizing its own unique vision.

The Origins of Bitcoin and Ethereum

Bitcoin and Ethereum’s introductions marked watershed moments in the digital finance industry, laying the groundwork for blockchain and decentralized finance (DeFi). Together, these projects have redefined money, investment, and the infrastructure of the internet, paving the way for a more transparent and accessible financial ecosystem.

Bitcoin’s Creation

Bitcoin was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. With its release, Bitcoin solved the double-spending problem for digital currency without relying on a central authority, initiating the decentralized finance movement. By facilitating peer-to-peer transactions, Bitcoin demonstrated blockchain’s ability to serve as a secure, independent financial network, establishing itself as both a currency and a store of value, frequently compared to “digital gold.”

Ethereum’s Development

Ethereum, proposed in 2013 by developer Vitalik Buterin, was launched in 2015 as a blockchain-based platform capable of running self-executing smart contracts. This breakthrough expanded blockchain’s potential, enabling the creation of DApps across industries. Ethereum’s mission was to harness blockchain’s power for a broader range of applications, laying the foundation for Web3 and decentralized innovation.

Bitcoin vs Ethereum: Technical Breakdown

From consensus mechanisms to transaction speeds, Bitcoin and Ethereum diverge significantly in technical design, which aligns with their different purposes.

Consensus Mechanism: Bitcoin employs proof of work (PoW), where miners solve complex puzzles to validate transactions. Ethereum has transitioned to a proof-of-stake (PoS) system, focusing on scalability, security, and energy efficiency.

Block Time: Bitcoin blocks are generated every 10 minutes, whereas Ethereum’s block creation is far quicker, averaging 12 seconds under PoS.

Smart Contracts and DApps: While Bitcoin’s scripting is limited to enhance security, Ethereum supports programmable contracts and applications, enabling a dynamic ecosystem for DApps.

Supply Limit: Bitcoin’s 21 million cap is central to its value as a scarce asset. Ethereum has no fixed supply, aligning with its emphasis on flexibility for DApp and smart contract execution.

These technical distinctions highlight Bitcoin’s role as a decentralized currency and Ethereum’s function as a flexible, application-supporting platform. Both have been instrumental in demonstrating blockchain’s transformative potential.

Key Features of Bitcoin

Bitcoin’s design includes a range of features that have fueled its adoption as a decentralized digital currency.

Blockchain Architecture: Bitcoin’s blockchain acts as a transparent ledger, maintaining transaction records on a distributed network. Each “block” holds a series of transactions, which are publicly accessible and nearly impossible to alter. This decentralized verification process bolsters Bitcoin’s security and independence from any central authority.

Mining System: Bitcoin relies on PoW, where miners compete to solve mathematical puzzles to validate transactions and add new blocks to the chain. This mining process both secures the network and gradually releases new bitcoins as rewards to successful miners.

Transaction Speed and Scalability: Bitcoin’s 10-minute block interval limits transaction capacity. Scalability remains a topic of debate, and solutions such as Segregated Witness (SegWit) and the Lightning Network have been developed to increase throughput.

Scaling Strategies: The Lightning Network, a secondary protocol layer, facilitates faster transactions by conducting them off-chain, addressing some of Bitcoin’s scalability challenges.

Key Features of Ethereum

Ethereum incorporates features that extend blockchain’s capabilities beyond financial transactions.

Smart Contracts: Ethereum’s introduction of smart contracts enables self-executing agreements with terms embedded in code. This innovation has facilitated trustless, decentralized transactions across sectors.

Ethereum Virtual Machine (EVM): The EVM allows smart contracts to run within Ethereum, acting as a universal computational engine that supports DApp creation and decentralized systems.

Ethereum 2.0 Upgrade: Ethereum’s transition to PoS with Ethereum 2.0 is expected to boost scalability, security, and energy efficiency. Sharding, a scaling solution introduced in Ethereum 2.0, will further enhance transaction speed and reduce costs.

These features position Ethereum as a versatile blockchain platform, offering functionality for DApps and decentralized protocols while also preparing to meet growing demands with Ethereum 2.0’s enhancements.

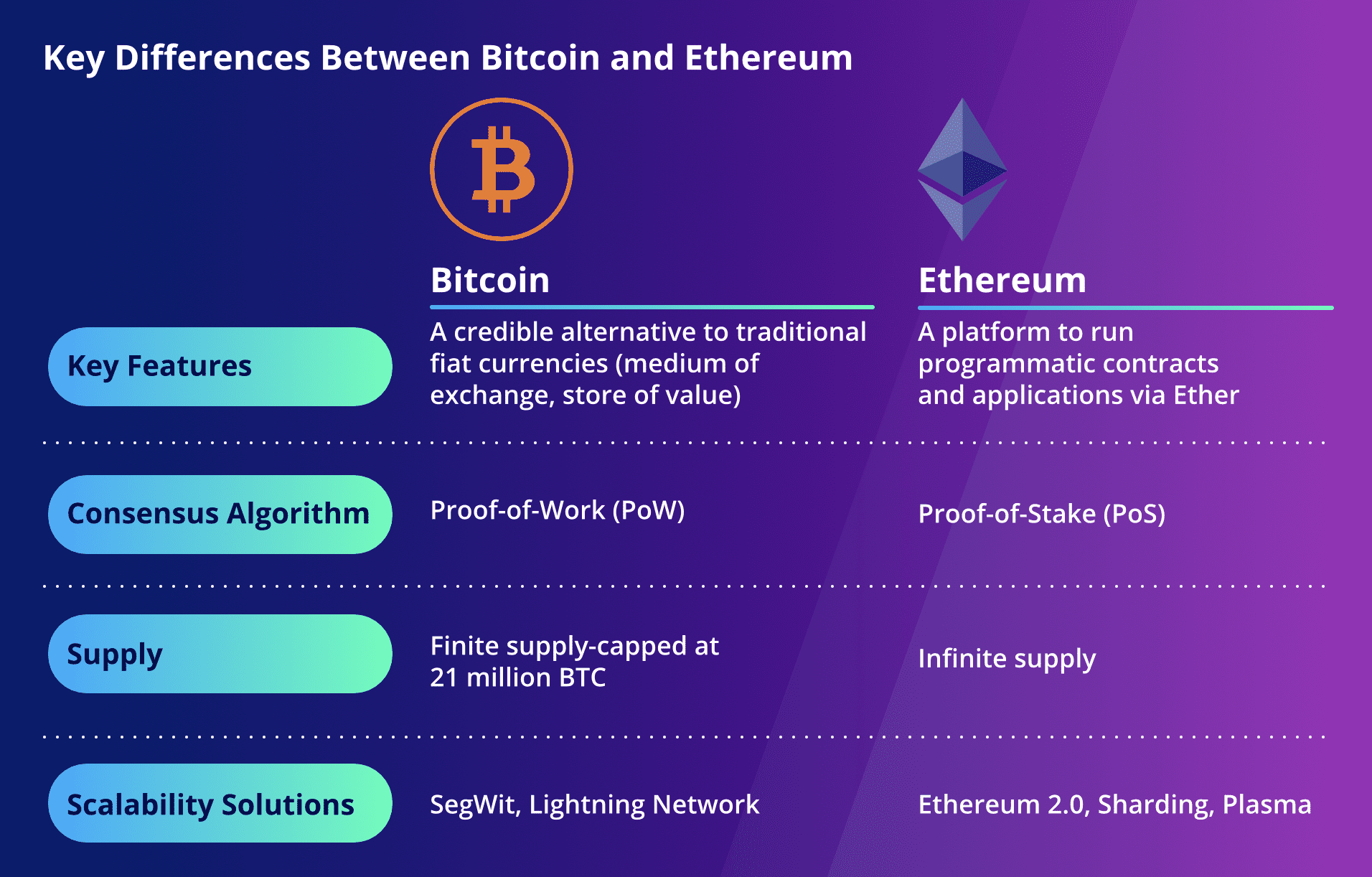

Core Distinctions: Bitcoin and Ethereum

Bitcoin and Ethereum’s distinct technological foundations and scaling strategies underscore their different objectives in the crypto space. Below are some key comparisons:

Technological Architecture

Bitcoin: Focused on secure, decentralized currency, Bitcoin’s PoW-based architecture reinforces network security. Scalability solutions like SegWit and the Lightning Network aim to enhance transaction efficiency.

Ethereum: With its platform-oriented design, Ethereum enables smart contract functionality, facilitating DApps. Its transition to PoS with Ethereum 2.0 prioritizes scalability, security, and reduced energy consumption.

Future Scalability Plans

Bitcoin: Scaling efforts focus on off-chain solutions and protocol improvements, preserving security and decentralization.

Ethereum: Ethereum 2.0 introduces sharding and PoS, designed to reduce congestion and lower transaction fees for a broader range of applications.

These distinctions underscore Bitcoin’s focus on secure currency, while Ethereum aims to become a global computing platform for DApps.

Market Trends: Bitcoin vs Ethereum

Examining Bitcoin and Ethereum’s market performance provides insight into the factors influencing their prices and adoption.

Historical Price Trajectories

Bitcoin: Since its launch in 2009, Bitcoin has experienced multiple price surges, notably in 2013 and 2017, and reached record highs of over $60,000 in 2021. This volatility reflects both investor interest and Bitcoin’s status as a speculative, high-growth asset.

Ethereum: Ethereum, which debuted in 2015, has seen similar volatility, with price peaks above $4,000, largely due to DeFi’s popularity and NFT-related activity on the platform.

Factors Affecting Prices

Market Demand: Bitcoin’s perception as “digital gold” fuels demand during economic instability. Ethereum’s demand is driven by its utility in DeFi, NFTs, and Web3 projects.

Technological Advancements: Bitcoin’s updates, such as the Lightning Network, have bolstered its value. Ethereum’s upgrades, particularly the shift to PoS, have positively influenced its price and broadened its use.

Investor Sentiment: Market sentiment, often swayed by news and regulations, significantly impacts both assets. Institutional investment and regulatory clarity tend to boost confidence, while adverse news can lead to rapid declines.

Practical Applications: Transactions and Beyond

Bitcoin: Known for facilitating secure, cross-border payments, Bitcoin has become a widely accepted digital currency. Its limited supply and decentralized nature appeal to investors seeking a hedge against inflation.

Ethereum: Ethereum’s smart contracts support an array of applications, including finance, gaming, and DAOs. By allowing developers to build DApps, Ethereum serves as a launchpad for blockchain innovation across industries.

The two assets thus serve different roles in the digital ecosystem, with Bitcoin providing a stable, decentralized currency and Ethereum enabling dynamic technology development.

Community and Development Ecosystems

Both Bitcoin and Ethereum have vibrant ecosystems that foster continuous advancement and innovation.

Bitcoin Community: Bitcoin’s development centers on improving security, scalability, and privacy, with initiatives like the Lightning Network aimed at enhancing transaction efficiency.

Ethereum Community: Ethereum’s open community actively builds DApps and smart contracts. Projects like the Ethereum Enterprise Alliance show ongoing collaboration to bring blockchain to traditional industries.

These collaborative communities ensure both Bitcoin and Ethereum’s resilience and progression as blockchain technology continues to evolve.

Investment Considerations for Bitcoin and Ethereum

Bitcoin is often seen as a store of value akin to gold, appealing to those seeking stability during economic uncertainty.

Ethereum offers a unique investment proposition through its support of decentralized applications and smart contracts, appealing to those interested in blockchain technology’s potential.

While both assets come with inherent risks due to market volatility, their foundational roles in a new digital economy offer promising long-term opportunities for investors.

Bitcoin vs Ethereum: Future Outlook

Experts remain optimistic about Bitcoin and Ethereum’s futures, despite potential market volatility. Both assets continue to see growing adoption and institutional interest, underscoring their long-term value.

As the ecosystem matures, Bitcoin is becoming more accessible to everyday users, with improvements in user-friendly wallets and payment integrations. Institutional investors are increasingly viewing Bitcoin as a stable, uncorrelated asset, useful for diversifying portfolios and as a hedge against inflation.

Ethereum’s transformative potential in decentralized applications and Web3 infrastructure makes it a leading candidate for long-term disruption in digital commerce. With Ethereum 2.0 in place, Ethereum’s influence on finance, gaming, and beyond is likely to expand.

Conclusion: Understanding Bitcoin and Ethereum’s Roles

Bitcoin and Ethereum each hold unique places in the digital finance landscape: Bitcoin as a decentralized currency and store of value, and Ethereum as a versatile platform for decentralized applications. Staying informed about their distinct pathways and ongoing innovations is essential for anyone involved in digital finance, as these assets continue to shape the future of both finance and technology.